Gold: Your Beacon to Financial Security

Date: November 3, 2024

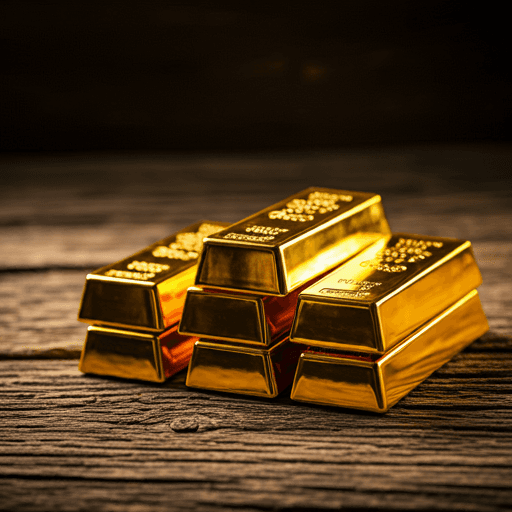

In an era marked by economic volatility, establishing a solid financial foundation has become more crucial than ever. Investing in gold has been a popular choice for centuries, thanks to its reputation as a stable asset that can preserve wealth even during turbulent economic times.

Why is Gold an Attractive Investment Option?

Gold is highly liquid, meaning it can be easily and quickly converted into cash, a vital quality during emergencies. Moreover, gold is an excellent hedge against inflation. As inflation rates rise, the value of gold tends to increase, making it a valuable asset for preserving purchasing power.

Reasons to Include Gold in Your Emergency Fund:

High Liquidity: Can be quickly converted to cash when needed.

Inflation Protection: Helps preserve the purchasing power of your money over time. Stability: Gold tends to be less volatile than other assets.

Diverse Investment Options: You can invest in gold bars, coins, or gold ETFs.

Conclusion

Investing in gold is a strategic move for long-term financial security, especially when included in an emergency fund. Whether the economy is booming or struggling, gold remains a valuable and sought-after asset.

Additional Tips:

Do Your Research: Before investing, thoroughly research the gold market and various investment options.

Diversify: Don't put all your eggs in one basket. Diversify your investments to reduce risk.